In the rapidly evolving world of finance, the emergence of cryptocurrencies has marked a revolutionary shift, particularly in Asia. With a diverse landscape that ranges from burgeoning economies to financial powerhouses, Asia has become a focal point for the cryptocurrency movement. fintechasia .net Crypto Facto segment stands out as an essential resource for both novices and seasoned investors aiming to navigate the complexities of this digital revolution. It provides a deep dive into the integration of blockchain technology with financial services, highlighting how this synergy is reshaping the economic fabric of the continent.

What is Fintechasia .net Crypto Facto?

The website fintechasia.net The Crypto Facto segment is more than simply a news source; it’s a complete reference that explains the complexities of the Asian cryptocurrency market. It discusses the major impact of digital currencies on the fintech industry, highlighting the transition to a more digitalized economy. This platform not only explains the technical principles of cryptocurrencies, such as blockchain technology and mining, but it also looks at their practical uses in transactions and investing methods. While acknowledging the potential benefits, such as increased transaction efficiency and financial inclusivity, Crypto Facto does not shy away from mentioning the drawbacks, which include volatility, security threats, and regulatory impediments. It seeks to provide its audience with the knowledge and tools they need to make educated decisions in this ever-changing landscape.

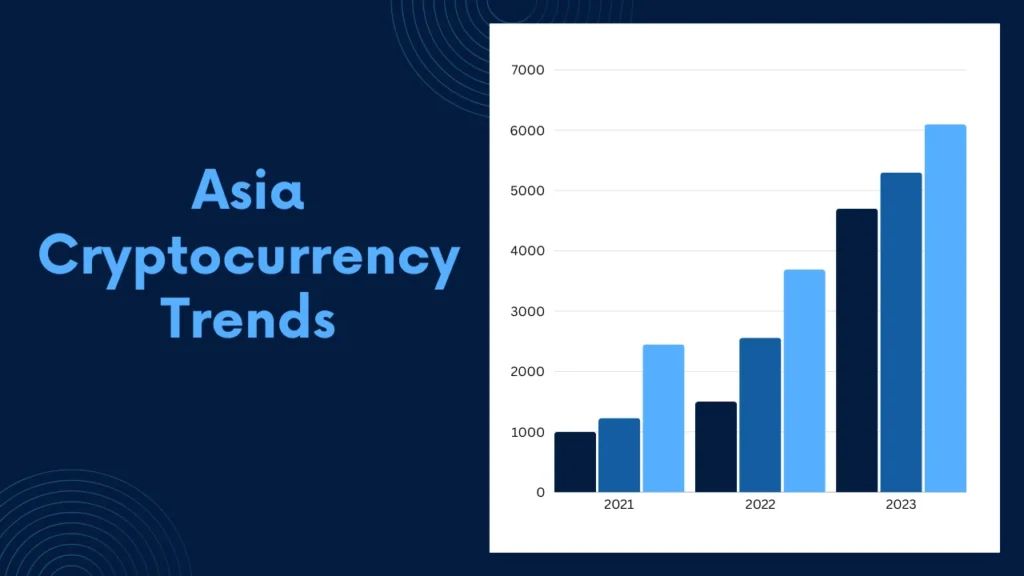

Asia Cryptocurrency Trends

The Asian market is at the forefront of bitcoin adoption, with patterns indicating both rapid development and new hurdles.

Blockchain Technology Insights

Blockchain technology serves as the foundation for cryptocurrencies, providing a decentralised, secure, and transparent method of conducting transactions. In Asia, its use extends beyond financial transactions to supply chain management and smart contracts, demonstrating the technology’s adaptability and promise for innovation.

Cryptocurrency Mining Asia

Asia is a cryptocurrency mining hotspot due to the availability of cheap electricity in certain areas and a competitive IT industry. However, this movement raises concerns about sustainability and regulatory approval, prompting differing responses from Asian countries.

Decentralized Finance Asia

Decentralised Finance (DeFi) is altering Asia’s traditional banking and financial services by providing more accessible, efficient, and less centralised alternatives. DeFi platforms have grown in popularity, demonstrating increased confidence and interest in peer-to-peer financial services.

Digital Currency Regulations Asia

The legal climate for cryptocurrencies in Asia is a patchwork of methods, with some nations welcoming digital currencies and others enforcing strict limitations. These regulations are critical in moulding the market’s future, influencing everything from investing plans to the use of digital wallets.

Financial Inclusion through Cryptocurrency

One of the most significant benefits of bitcoin in Asia is the possibility for increased financial inclusion. Cryptocurrencies can play a critical role in economic empowerment across the continent by giving unbanked and underbanked populations with access to financial services.

Cryptocurrency Security Measures

As the usage of digital currencies expands, so does the significance of having comprehensive security measures to safeguard against fraud and cyberattacks.

Secure Investment Strategies

The volatility of the cryptocurrency market needs cautious investing tactics. Diversification, recognising market patterns, and staying current on regulatory developments are critical for securing investments in the volatile cryptocurrency field.

Regulatory Environment for Crypto Asia

Understanding the regulatory landscape is critical for both firms and investors. Staying up to date on legislative changes and knowing how these policies affect cryptocurrencies can help to reduce risks and maintain compliance.

Crypto Volatility and Risk Management

The tremendous volatility of cryptocurrencies can be a double-edged sword, providing the opportunity for big rewards while also posing enormous danger. Navigating this volatility requires effective risk management measures, such as comprehensive research and a thorough understanding of market dynamics.

Decentralized Applications (DApps) Asia

The emergence of DApps in Asia demonstrates the region’s ingenuity in utilising blockchain technology for a wide range of applications other than financial transactions. These applications highlight how decentralisation has the ability to alter businesses by increasing service accessibility and efficiency.

Emerging Opportunities for Businesses

The bitcoin rise in Asia opens up several prospects for businesses. The landscape is ideal for entrepreneurial enterprises, with startups introducing innovative financial services and traditional companies embracing blockchain for efficiency. The objective is to identify niches where cryptocurrencies may address current problems or improve services, such as remittances and cross-border transactions.

Investor Strategies for Cryptocurrency Investments

Investors in Asia are becoming interested in cryptocurrencies as an asset class. Creating a solid investment strategy entails examining market trends, understanding the technological basis of potential investments, and implementing risk management techniques. Given the market’s volatility, a well-thought-out approach can make the difference between substantial gains and losses.

Impact of Cryptocurrency on Asian Economies

The widespread adoption of cryptocurrencies has the potential to profoundly affect Asian economies. Digital currencies have the potential to boost economic growth by lowering transaction costs, boosting payment efficiency, and opening up new investment options. However, authorities exercise caution, weighing the benefits of innovation against the need to safeguard customers and maintain financial stability.

Blockchain and Fintech Integration

The combination of blockchain technology and fintech ideas is transforming Asia’s financial system. This integration not only changes the way transactions are handled, but it also introduces new types of financial interaction.

Enhancing Transaction Efficiency and Transparency

Blockchain’s fundamental qualities, such as immutability and decentralisation, improve the efficiency and transparency of financial transactions. These characteristics eliminate the need for intermediaries, expedite processes, and cut expenses, making financial services more affordable.

Digital Wallets and Transactions Evolution

Digital wallets are at the forefront of blockchain and finance integration, allowing for frictionless bitcoin transactions. The evolution of these wallets, which includes features such as multi-currency compatibility and increased security measures, reflects the increasing sophistication of crypto transactions in Asia.

Adoption of Decentralized Finance (DeFi) Models

DeFi challenges established financial paradigms by providing decentralised lending, borrowing, and investment options. DeFi is gaining popularity in Asia due to its promise to democratise finance by providing more inclusive and less reliant services on traditional financial institutions.

Digital Currency Regulations Asia

The regulatory regimes for digital currencies in Asia differ greatly from one another, reflecting various approaches to balancing innovation and consumer protection.

Regulatory Challenges and Compliance

Navigating the regulatory climate presents a significant hurdle for cryptocurrency firms and investors. Compliance with developing legislation necessitates ongoing vigilance and agility, as authorities strive to manage the risks connected with cryptocurrencies while not stifling innovation.

Impact of Regulations on Market Dynamics

Regulations have a substantial impact on market dynamics, affecting both the availability of cryptocurrencies and investor engagement. In certain jurisdictions, favourable policies have boosted growth, while in others, stringent measures have dampened enthusiasm for virtual currencies.

Collaborative Efforts for Regulatory Harmonization

Given the international character of cryptocurrencies, there is an increasing demand for regulatory harmonisation across Asia. Collaborative efforts among countries could result in more consistent regulatory frameworks, lower entry barriers, and a more stable and predictable marketplace.

Cryptocurrency Security Measures

As the cryptocurrency industry grows, the security of digital assets has become increasingly important. The distinctive nature of cryptocurrencies necessitates similarly novel security measures.

Advanced Security Protocols for Digital Wallets

To prevent unauthorised access and cyber theft, digital wallets are increasingly using complex security protocols such as multi-factor authentication and hardware security modules.

Educating Users on Security Best Practices

One important part of security is educating users on best practices, such as recognising phishing attempts and safeguarding private keys. Increased awareness can greatly lower the likelihood of security breaches.

Implementing Regulatory Measures for Security

Regulatory organisations in Asia are taking steps to protect the security of bitcoin transactions. These include regulating the use of cold storage for large quantities of digital currency and conducting frequent security audits on exchanges and wallet providers.

Frequently Asked Questions

1. What is the impact of blockchain technology on the fintech sector in Asia?

Blockchain technology is dramatically revolutionising Asia’s fintech sector by increasing the efficiency, transparency, and security of financial transactions. It enables decentralised finance (DeFi), streamlines supply chains, and opens up new avenues for innovation and financial inclusion, reducing reliance on traditional banking and financial intermediaries.

2. How do cryptocurrency regulations vary across Asian countries?

Cryptocurrency legislation in Asia vary greatly, reflecting the various approaches of each country. Some countries have welcomed cryptocurrencies, establishing legislative frameworks that promote innovation and growth. Others, on the other hand, have implemented strict rules or outright bans in response to worries about security, fraud, and financial stability.

3. What are the key strategies for investing in cryptocurrencies in Asia?

Key tactics for investing in cryptocurrencies in Asia include completing extensive market research, diversifying investment portfolios to mitigate risk, maintaining up to current on regional legislative changes, and understanding the technological principles of blockchain and digital currencies. Furthermore, because of the market’s inherent volatility, it is critical to practice safe investing.

4. How are digital wallets evolving in Asia’s cryptocurrency market?

Digital wallets in Asia’s bitcoin market are growing to include more security measures, multi-currency functionality, and better user interfaces. Biometric security measures, hardware wallet support for cold storage, and seamless transactions across different blockchain networks are among the innovations that address the growing demand for convenient and secure digital asset management.

5. Can cryptocurrencies improve financial inclusion in Asia?

Yes, cryptocurrencies have the potential to greatly increase financial inclusion in Asia by giving access to financial services to the unbanked and underbanked. Individuals who do not have access to traditional banking can participate in the global economy by using digital wallets and decentralised financial platforms to send and receive payments, as well as access loan and investing opportunities.

Must Read: Next Crypto Bull Run: In-Depth Market Analysis

Conclusion

The website fintechasia .net Crypto Facto demonstrates the transformational power of cryptocurrencies in transforming Asia’s financial landscape. It is an invaluable resource for anyone wishing to understand or connect with the Asian cryptocurrency market, as it provides in-depth analysis, highlights developing trends, and addresses the sector’s issues. As the digital currency revolution proceeds, Crypto Facto’s insights will definitely play an important role in helping investors and enthusiasts through the confusing but exciting world of cryptocurrencies.

Brandy Stewart, an enchanting wordsmith and seasoned blogger, weaves compelling narratives that transport readers to uncharted territories. Infused with perceptive viewpoints and dynamic storytelling, Doris exhibits a command of language that enthralls both hearts and minds, leaving a lasting mark on the literary panorama.