Creating a compliant Swiss invoice is essential for any entrepreneur or small business owner operating in Switzerland. Whether you are a freelancer, a startup founder, or a small business owner, ensuring your invoices meet the legal requirements can be a time-consuming and complex task. Fortunately, Magic Heidi, an online invoicing platform, simplifies this process by providing an easy, efficient way to generate professional Swiss invoices that adhere to all regulations.

This guide will walk you through everything you need to know about creating a Swiss invoice, including the essential elements, legal requirements, and how to use Magic Heidi to streamline your invoicing process.

Why Invoicing is Crucial for Swiss Entrepreneurs

Invoicing is a fundamental aspect of running a business. It ensures that you get paid for your services, provides clear records for accounting purposes, and helps you stay compliant with Swiss tax laws. A well-prepared invoice offers transparency to your clients, ensuring they understand the amount due, payment terms, and any applicable taxes.

However, Swiss law has specific invoicing requirements, and failing to meet these could result in delays in payment, disputes with clients, or penalties from tax authorities. This is why it’s crucial to follow a structured invoicing process, ensuring that your invoices are clear, concise, and fully compliant.

Key Elements of a Compliant Swiss Invoice

Before diving into how Magic Heidi can assist you in generating invoices, let’s first understand the key elements required in a Swiss invoice. Every invoice issued by a Swiss business must include the following:

1. Your Business Information

Your invoice must clearly display your company’s legal name, address, and contact details. If you are a sole trader or freelancer, you should include your personal name and business name (if applicable).

2. Client Information

Include the name, address, and contact details of your client. This helps ensure the invoice reaches the right person and provides clarity for tax and legal purposes.

3. Invoice Date and Number

Swiss law requires that every invoice has a unique invoice number and a clear issue date. The invoice number must follow a logical sequence, ensuring there are no gaps in your invoicing records.

4. Description of Goods or Services

Provide a detailed description of the products or services you are billing for. The description should be clear enough that both you and the client can easily identify the items being invoiced.

5. Payment Terms

Clearly state the payment terms on the invoice, including the due date for payment, the accepted payment methods, and any discounts or late fees that may apply.

6. Subtotal, Taxes, and Total Amount

Show the total amount before tax (subtotal), applicable VAT (Value Added Tax), and the total amount due. In Switzerland, VAT is required on most transactions, and invoices must indicate the VAT percentage and the corresponding VAT amount.

7. VAT Registration Number (If Applicable)

If your business is VAT registered, you must include your VAT number on the invoice. For businesses earning more than CHF 100,000 annually, VAT registration is mandatory. This ensures that you are compliant with Swiss tax regulations.

8. Banking Information

Include your bank details (IBAN or account number) so your clients know where to send the payment. You may also include details for other payment methods such as PayPal or credit card if applicable.

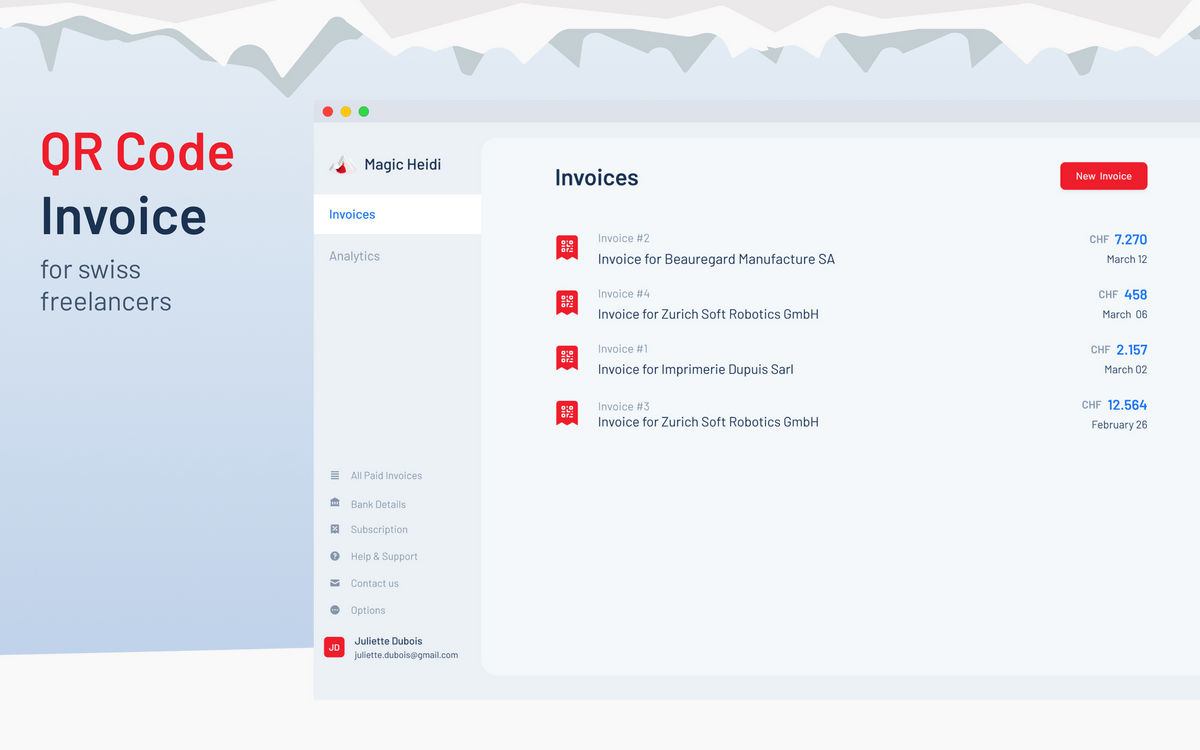

How to Create a Swiss Invoice Using Magic Heidi

Now that we’ve covered the essential elements of a Swiss invoice, let’s explore how Magic Heidi simplifies the process of generating compliant invoices. As an online platform, Magic Heidi is designed for entrepreneurs and small businesses in Switzerland who want to automate and streamline their invoicing processes.

1. Sign Up for Magic Heidi

The first step in creating a Swiss invoice with Magic Heidi is to sign up for an account. You can do this by visiting the Magic Heidi website. Once you’ve registered, you’ll have access to the platform’s invoice generation tools.

2. Choose Your Invoice Template

Magic Heidi offers customizable invoice templates that are compliant with Swiss regulations. Select the template that best fits your business needs. You can customize the template to include your business logo, colors, and personal branding, ensuring that your invoices look professional and aligned with your brand.

3. Input Your Business and Client Information

After selecting a template, you’ll need to input your business details (name, address, VAT number) and your client’s information. Magic Heidi allows you to save client details for future invoices, which makes the invoicing process quicker for repeat customers.

4. Add Items or Services

Next, input the items or services you are invoicing for. Magic Heidi allows you to add a description, quantity, and price for each item or service. The platform will automatically calculate the subtotal, VAT (if applicable), and the total amount due.

5. Set Payment Terms

Within the invoice, set the payment terms, including the due date, payment methods, and any additional terms like late fees or early payment discounts. You can also customize the currency based on your client’s location if you are dealing with international customers.

6. Generate and Send the Invoice

Once you’ve completed all the necessary fields, you can preview the invoice to ensure everything is correct. Magic Heidi allows you to send the invoice directly to your client via email or download it as a PDF for manual sending.

7. Track Payments

Magic Heidi not only helps you create invoices but also tracks payments. You can monitor which invoices have been paid, which are still outstanding, and even send reminders to clients who are late on payments.

Benefits of Using Magic Heidi for Swiss Invoicing

There are several reasons why Magic Heidi is the ideal invoicing platform for Swiss entrepreneurs and small businesses:

1. Compliance with Swiss Regulations

Magic Heidi ensures that all invoices generated on the platform meet Swiss legal requirements, reducing the risk of errors and non-compliance.

2. Time-Saving Automation

With features like client information storage, automatic tax calculations, and pre-set payment terms, Magic Heidi significantly reduces the time spent on manual invoicing.

3. Professional Customization

The ability to customize invoice templates with your brand’s colors, logo, and fonts ensures your invoices look professional and polished.

4. Payment Tracking and Reminders

Never lose track of outstanding payments with Magic Heidi’s built-in tracking and reminder system. This feature ensures you get paid on time and avoid cash flow issues.

5. User-Friendly Interface

Magic Heidi’s platform is designed to be easy to use, even for those who are not tech-savvy. With intuitive navigation and clear instructions, you can start generating invoices in minutes.

FAQs

1. What information do I need to create a Swiss invoice?

To create a Swiss invoice, you will need your business information, client details, invoice date and number, a description of goods or services, payment terms, subtotal, VAT (if applicable), total amount due, and your banking details.

2. Is Magic Heidi compliant with Swiss tax laws?

Yes, Magic Heidi is designed to comply with Swiss invoicing and tax regulations, ensuring your invoices meet all legal requirements.

3. Can I customize my invoice with Magic Heidi?

Yes, Magic Heidi offers customizable templates that allow you to add your logo, brand colors, and other personal touches to make your invoices look professional.

4. How does Magic Heidi help with payment tracking?

Magic Heidi has a payment tracking feature that allows you to see which invoices have been paid, which are pending, and which are overdue. You can also send payment reminders to clients.

5. Is Magic Heidi suitable for small businesses and freelancers?

Yes, Magic Heidi is perfect for small businesses, freelancers, and entrepreneurs who need an easy-to-use platform for generating professional and compliant invoices.

Conclusion

Creating a compliant Swiss invoice doesn’t have to be a complex process. With Magic Heidi, entrepreneurs and small business owners can easily generate professional, compliant invoices in just a few steps. By following Swiss invoicing regulations and using Magic Heidi’s automated features, you can focus more on growing your business and less on administrative tasks. Whether you’re a freelancer or a small business owner, Magic Heidi is the ideal tool to ensure your invoicing process is seamless, efficient, and legally compliant.